Summary

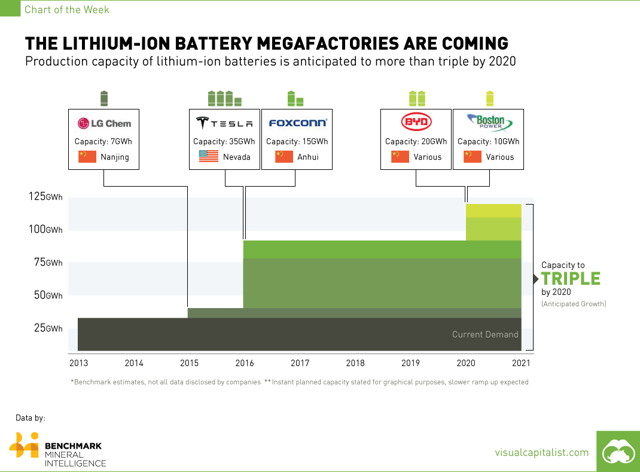

- The lithium mega-factories will help lithium battery prices to fall below $200/kWh by 2020, and below $100/kWh by 2024.

- By 2020, an EV will sell for under $30,000, and before 2025 for $20,000.

- Investors can buy the EV companies, the battery manufacturers or the lithium/cobalt/graphite/nickel miners.

by Matt Bohlsen for Seeking Alpha

I have followed the electric vehicle (EV) movement since the early days of Tesla (NASDAQ:TSLA). Over those years, I have seen EVs struggle, and now boom. The key is lithium-ion battery prices falling. This will drive down EV and energy storage prices, which will massively increase demand.

In this article, I will illustrate that EVs are a question of not “if,” but “when.”

Once you are convinced that EVs are coming, and at a rapid pace, you can choose how best to invest in this boom.

A recap of the evidence that the EV and lithium boom are upon us.

- EV sales grew globally by around 50% in 2014 and 2015, and 223% in China in 2015. 2016 world sales are up 48% YTD, and heading towards 800,000 for the year.

- China has set a target for 5 million (NYSE:M) new energy vehicles by 2020, and a charging station network to cover 5m EVs. India’s EV target is 6m EVs on the road by 2020, and to electrify the country’s entire auto fleet by 2030.

- China plans to be the “epicentre of electrification of the auto industryglobally.”

- China currently has 200 million electric two wheelers. Over the next decade, most of these will convert to lithium, due to cheaper, lighter and longer lasting lithium batteries.

- Over the next two years, 25 new makes and models of electric cars are expected to be released. Byd (OTCPK:BYDDF) and Tesla currently lead global sales.

- Ford (NYSE:F) is spending USD 4.5b to add 13 new EV models to electrify 40% of its vehicle lineup by 2020. Audi plans to introduce a new EV model every year beginning in 2018.

- General Motors (NYSE:GM) has the Bolt coming in 2016, Nissan (OTCPK:NSANY) has the Leaf, Toyota (NYSE:TM) the Prius, Mitsubishi (OTCPK:MSBHY) the Highlander. Others with EVs include Volkswagen (OTCPK:VLKAY)(Audi/Porsche), BMW (OTCPK:BAMXY), Daimler Mercedes Benz (OTCPK:DDAIF), Renault (OTC:RNSDF), Volvo (OTCPK:VOLVY), Mazda (OTCPK:MZDAF), Honda (NYSE:HMC), Hyundai (OTC:HYMTF), and Kia (OTC:KIMTF).

- Ian Callum, head of design for Jaguar, stated in April 2016: “Car design will change more in the next 15 years than it has in the past 100-electrification will kick start the biggest change in automotive design in history.”

- Daimler Mercedes Benz says (in June 2016), “battery electric cars will be able to run for 500 kilometers between five-minute recharges – and outperform any petrol-powered car on the road – in less than five years.”

- China’s lithium-ion battery production tripled in 2015.

- Goldman Sachs (NYSE:GS) calls “lithium the new gasoline.” They forecast 22% EV penetration by 2025, and “lithium demand for all EV applications could grow more than 11x by 2025.”

- Macquarie Bank says “lithium is the new wonder resource in the mining sector,” and that “demand is expected to systemically outstrip supply in a few years, driven by an estimated 31% CAGR of EVs to 2021.”

- The lithium-ion price in China trebled in the past 6 months from 6,000 per tonne, to over 18,000 per tonne. This is mostly due to increased demand from electric vehicles (buses, cars and bikes).

- 12 lithium ion battery “mega factories” are set to come on line (or expand) by 2020, according to Benchmark Mineral Intelligence (and 7 of those in China).

- The Economist magazine recently called lithium “the world’s hottest commodity.”

- Tesla’s Elon Musk also recently announced that Tesla “could triple the total planned battery output of the Gigafactory to ~105 GWh of cells and ~150 GWh of battery packs – or over 3 times the current total lithium-ion battery production worldwide.” He also stated around half of this capacity would be needed to cater for the growing energy storage business.

- Apple (NASDAQ:AAPL) is working on a secret project called Project Titan, to build an electric car. Musk believes Apple will have a car in the market by 2020.

- Foxconn (OTC:FXCOF) is now planning to make a USD 15,000 EV.

- EVs accounted for nearly 30% of all new cars sold in Norway in 2015.

- Norway’s four major political parties are readying a bill to ban the sale of gas-powered cars by 2025.

- Germany announced that by 2030, all new cars registered in the country must be electric vehicles. India has a plan to achieve the same result as Germany.

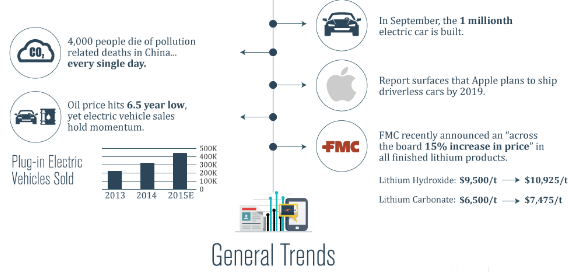

General Trends – EVs

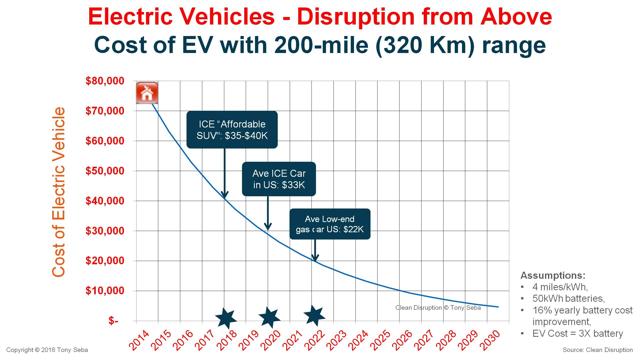

By 2020, an EV will sell for USD 30,000, and by 2022 (Seba forecast) for USD 20,000.

Tony Seba forecasts:

- By 2020, energy storage to power a US house (30kwh/day) will drop to just US 1.20 per day, due to battery energy storage (and storing electricity at off peak cheap rates).

- By 2020, we will get to USD 200kWh lithium-ion battery costs, and a 200-mile range EV for USD 30,000. See graph below.

- By 2022, we will get to the holy grail of a 200-mile range EV for USD 20,000.

- By 2024, we will get to the holy grail of USD 100 kWh lithium-ion battery costs. The lower battery cost will be mostly due to the megafactories and large-scale manufacturing.

- By 2025, we will reach 100% EVs of all new car sales.

The EV Cost curve of Tony Seba – USD 20,000 EV by 2022

NB: The author is grateful for permission from Tony Seba to publish the above chart.

NB: Tony Seba assumes a 50kWh battery, and a 16% pa decline in battery prices, and an “unsubsidized” cost curve.

My forecast – EVs will be common by 2020, and dominate by 2022-2025

Due to EVs now having at least a 200-mile range, charging networks, and priced at $30,000 (or lower) by 2020, EVs will start to become more popular, especially given near zero running costs and near zero maintenance.

In the table below, I forecast the following:

By 2025, a 60kWh EV will sell for USD 20,000 – and achieve 60% market share. This may even end up being higher than 60%.

Buyers will choose an EV as it will be cheaper to BUY (or the same price as an ICE car), cheaper to RUN, and cheaper to MAINTAIN.

It will also be much better for our environment, and massively help remove air pollution.

My forecasts for battery costs and EV selling prices and EV market share as a % of all new vehicles sold

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Li battery

costs $/kWh |

375 | 315 | 265 | 222 | 187 | 157 | 132 | 111 | 93 | 78 |

| 60kWh battery cost

($,000) |

22.5 | 18.9 | 15.9 | 13.3 | 11.2 | 9.4 | 7.9 | 6.6 | 5.6 | 4.7 |

| 60kWh EV

sell for ($,000) |

37.5 | 33.9 | 30.9 | 28.3 | 26.2 | 24.4 | 22.9 | 21.6 | 20.6 | 20 |

| EV market share (%) | 1 | 2 | 3 | 6 | 10 | 20 | 30 | 40 | 50 | 60 |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Tony Seba

50kWh EV cost ($,000) |

30 | 20 |

NB: I have assumed lithium battery prices reduce by 16% pa, due to megafactories bringing scale. I have added USD 15,000 to the battery cost to get the EV selling price, based on the fact an ICE car can sell today profitably with an engine etc. for USD 20,000. All $ are in USD, and each item refers to the start of the year mentioned.

NB: Tesla and GM are already ahead of the above costs.

The ICE car companies now get it and are moving toward EVs

When I see 25 new EV models coming within 2 years, all the conventional car companies planning several EV models (Ford has 13 planned as mentioned above), I see Tesla achieving close to 400,000 orders for the Model 3 at least 2 years ahead of when it will be available, I see 12 new battery megafactories coming, I see massive charging networks being built (Tesla, ChargePoint, China plans charging stations able to handle 5 million plug in cars by 2020), I see Norway (by 2025) and Germany (by 2030) banning ICE vehicles, then I am convinced it is no longer a matter of if, but when.

I see the “when” as being 2020 to 2025, when EVs will blast off based on their more competitive pricing, and rapidly gain market share.

The smartphone boom started in 2007, and 9 years later (today), almost everyone buys a smartphone not an old Nokia.

If you still need convincing, then I suggest you read my article on “electric vehicles will most likely be the next big thing,” or watch this excellent Tony Seba video on the “electric vehicle disruption,” where you will learn how EVs will be cheaper than the average priced Internal Combustion Energy (ICE) cars by around 2020, or shortly thereafter.

You are now convinced EVs will very soon become mainstream – How to invest?

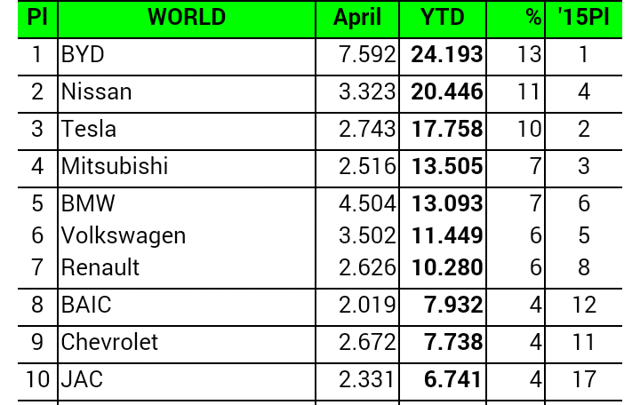

Option 1 – Buy the car companies leading the revolution.

The table below shows the current EV leaders.

Top ten EV manufacturers as of end April 2016

NB: Ford and Toyota were just outside the top ten but sure to improve.

The pure EV companies such as Byd Co., Tesla, BAIC, SAIC, Kandi (NASDAQ:KNDI), Zoyte, and Faraday Future are probably the best way to play the coming EV boom. However, the conventional car companies such as Nissan, Toyota, General Motors and Ford are very attractively priced and adapting quickly to produce EVs. For example, GM is on a P/E of just 5.6, and Ford 5.5. This will depend on your view of market share going forward. Obviously, the incumbent gas powered car companies have a lot of potential market share to lose, and factories to retool etc., hence they are priced so cheap.

My choice for now would be Byd Co. on a P/E of 27. They are global number 1 in EV sales, they are global number 1 in electric buses and taxis, big in energy storage batteries, and are making record profits. This year, they plan to double EV sales from 60k to 120k. You can read why here. Tesla is also an obvious choice here. However, I will enter at a lower price if possible, as I see the stock as being fully valued for now.

Option 2 – Buy the lithium ion battery manufacturers

With an expected 11x increase in lithium demand expected just for EVs (according to Goldman Sachs), add to this energy storage, and you can see a strong tailwind for the lithium ion battery manufacturers.

They include Panasonic (OTCPK:PCRFY), Tesla, LG Chem (OTC:LGCLF), Samsung SDI (OTC:SSDIY), Byd, Foxconn, Boston Power, Nanjing, and soon Leshen (private). You can read more here.

All of the above mentioned battery factories have large potential to increase sales volumes. However due to strong Chinese competition, profit margins are expected to be tight. If I was to choose one, it would be LG Chem (noting I already picked Byd in the EV section). LG Chem has recently become the world’s largest battery supplier, having at least 13 global automakers among the top 20 global brands. LG Chem currently supplies Volkswagen, Ford, Hyundai, Renault, Audi, Chevrolet, Kia, Daimler and GM.

Option 3 – Buy the miners – lithium, cobalt, graphite, and nickel.

The lithium ion battery contains mostly lithium, cobalt, graphite, and nickel. I discussed the main miners in the “lithium ion battery trifecta“, and the lithium miners here and here, the cobalt miners here, and the graphite miners here.

Needless to say, there are many miners that will ultimately be needed to feed the battery factories and supply the raw materials for the EV lithium ion batteries.

In creating an EV portfolio, I will just choose one from each.

My top pure play lithium miner right now would be Galaxy Resources (OTCPK:GALXF) (ASX:GXY). You can read my top 5 here and about Galaxy here.

My top pure play cobalt miner would be Formation Metals (OTCQB:FMETF) [TSX:FCO]. Note Formation is a junior and not yet in production, but pure play cobalt miners are hard to find.

My top pure play graphite miners would be Syrah Resources (OTCPK:SYAAF)(ASX:SYR).

I have not included a nickel miner, as nickel is facing headwinds from a slowing China construction industry.

To read why I choose the above, refer back to the links for my articles on lithium, cobalt, and graphite miners.

Risks

- EV adoption may stall.

- Government incentives may drop off sharply. This will just cause a dip, it won’t stop the trend.

- Lithium battery prices won’t continue to fall, which will halt the fall in EV prices. Unlikely given the megafactories coming online soon, and the increased competition, scale, and improvements in the supply chain.

- Access for charging EVs. Currently, those living in high-rise buildings can have some issues charging. However, over time and increasing consumer demand, condo buildings will allow residents to have their own power outlet in the car parking areas.

- The lithium and other miners won’t be able to meet demand. Actually, this is a serious threat. If EV penetration hits 10% by 2020, that will mean around 7.5m (10% of 75m) new EVs produced in 2020. Each 1m EVs requires between 70-150kt of lithium carbonate equivalent (LCE). So 7.5m EVs would require 525k-1,1250k tonnes of LCE in just one year. That looks near impossible, or would require very rapid and massive expansion of all miners, and to be planned in advance.

- By 2024, if my forecast 50% EV penetration proves correct. 37.5m EVs would require 2.6-5.6 million tonnes of LCE per year. In 2016, the lithium miners will produce only 200k tonnes LCE pa. This will mean at least a 13-28 fold increase in lithium production will be needed, without factoring in increased demand from other areas such as smartphones and energy storage. Clearly, a very big challenge for the miners (lithium, cobalt, graphite, nickel) to provide a massive increase in raw materials, and should be a boom for their profits and stock prices.

NB: This assumes batteries use the same amount of lithium as today, and is based on a 60kWh EV.

Conclusion

The whole point to the article is to show investors that we are most likely only in the first year of a 10-20 year EV boom. EV penetration is only at 1% of new sales, but likely to grow at a rate of at least 50% pa from now until the foreseeable future, perhaps increasing as EV prices become very affordable.

Investors can profit enormously still if they take wise positions in the EV and lithium/cobalt/graphite boom. The upside is still huge.

I believe, most analysts are underestimating the rate and size of this boom to come. I think Goldman Sachs’ forecast of just 22% EVs by 2025 will be increased along the way closer to my forecast of 60% EV saturation by 2025. Usually, when a better technology arrives, once it is at the same price or cheaper (2020-2025 for EVs), then mass adoption will occur rapidly (as per the “S” curve). The time to invest is now before stocks get too expensive, and be prepared to add on dips along the way. Best to have a 10-year time horizon, to allow time for the boom to play out.

My brief EV/lithium boom portfolio is as follows:

EV car companies – Byd Co. (many will choose Tesla here, which is fine if you are a long-term holder).

Lithium ion battery manufacturers – LG Chem.

Battery raw materials miners – Galaxy Resources (or Orocobre (OTCPK:OROCF), or both), Formation Metals, Syrah Resources.

You may well choose a different portfolio, which is fine. This article is not focused on picking the best stock, but seeing the big picture and macro theme. The key is to be in early on what will be, in my view, the biggest trend and investment opportunity since the smartphone (and Apple). Like any boom, the wisest way is to place several investments across the main areas, to be sure you capture the overall rise.

I see the miners as the greatest potential gainers, as most of them have market caps well under USD 1b right now, compared to say Tesla at USD 32b, or Byd at USD 20b. In particular, the pure play lithium miners as they are benefiting from a surge in EVs, energy storage, and smartphones.