Introduction

There’s a steady stream of good news from clean-tech industries, but the mainstream media don’t report on continuous good news. Like wind and solar investments exceeding fossil fuel investments for power generation. And electric vehicle (EV) battery prices plummeting. Clean technologies continue to get cheaper as we build more of them, vs. fossil fuel exploration, extraction, and consumption, that are getting more expensive. Renewables are now depressing oil and coal prices and will keep energy prices low for the foreseeable future. This will stress coal first and most, then oil, then gas companies. Therefore each day we’re another day closer to the end of fossil fuels.

The Energy Revolution is Happening Now

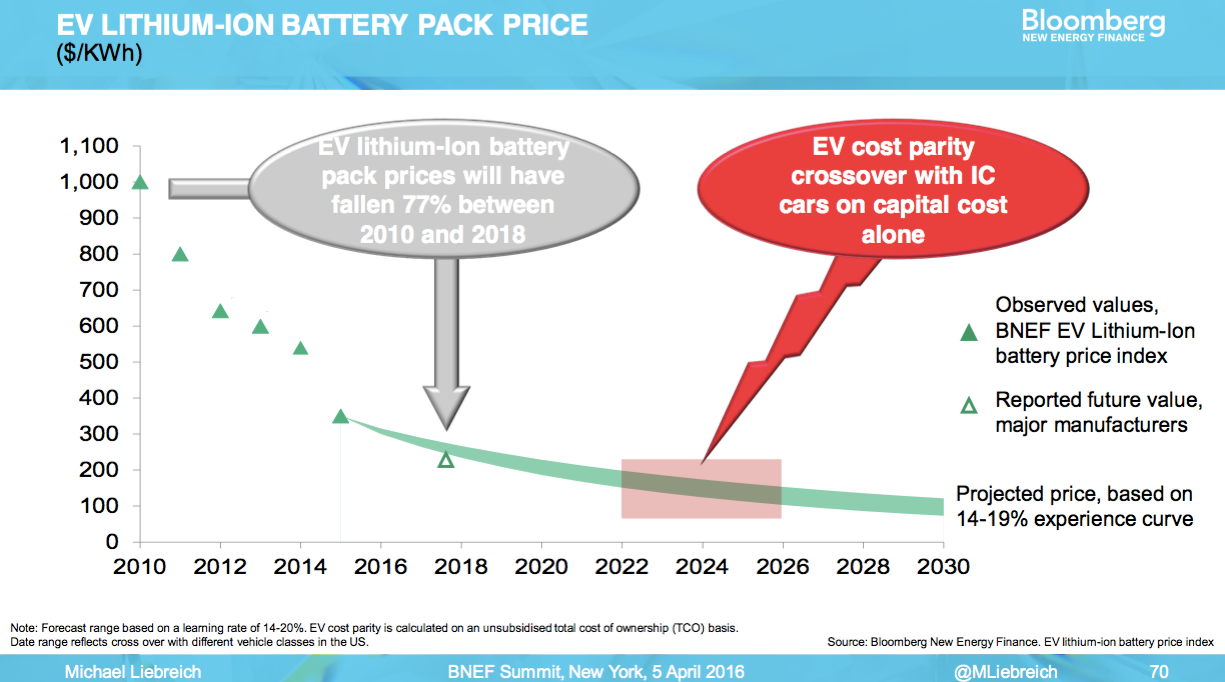

Bloomberg New Energy Finance (BNEF) tracks and analyzes global energy investments and annually forecasts future energy markets. A key driver of clean tech is that we learn more as we build and deploy more products. Such “experience curves” are common in technology industries and can be used to extrapolate future costs. Thus even without any further technology breakthroughs, the costs of wind power can be expected to fall about 19% for every doubling of accumulated production, and solar photovoltaics about 24% for every doubling of accumulated production.

This experience manifests itself in continuously cheaper technology products, just like computers, flat-screen TVs, or LED light bulbs. The US Department of Energy recently reported that key energy technologies have become significantly cheaper in the past six years.

This experience manifests itself in continuously cheaper technology products, just like computers, flat-screen TVs, or LED light bulbs. The US Department of Energy recently reported that key energy technologies have become significantly cheaper in the past six years.

BNEF is forecasting that cost parity for electric cars will be driven by decreasing costs of lithium-ion batteries, achieving parity on capital costs around 2024. Since the fuel and maintenance costs of EVs is already significantly lower than conventional vehicles, this signals a major disruption coming in automobiles and their fuels.

Economic Effects of the Energy Revolution

Economic Effects of the Energy Revolution

The results of these crossovers include a glut of energy of all types on the world market for the foreseeable future, continuing growth in renewable investments, and a sharp drop in oil and gas capital investments in 2015.

The investor message from the above data is to divest from fossil fuels before they all go the way of coal companies. Since 2012, 44 US coal companies have gone bankrupt, and the top 4 coal companies could leave us $2.7 billion of cleanup costs. In 2015 alone, 37 US oil and gas companies went bankrupt.

The above costs do not assume any clean-tech subsidies, which have the effect of accelerating the cost crossover points. They also do not assume any externalized costs of fossil fuel subsidies. Since there is little political hope of including these social costs of fossil fuels in their market prices, the effect of reducing fossil-fuel consumption is to reduce various health and future climate-change costs to society.

Third-world countries are already skipping over fossil fuels and setting up renewable energy systems, analogous to how they skipped over wired telephone systems and went directly to cell phones.

Political Effects of the Energy Revolution

Global energy markets total around $6 trillion, so the competition is already fierce and ugly. Scheming tactics from the fossil fuel industry will continue, since it is increasingly a cornered animal fighting for survival. Massive disinformation campaigns have been secretly funded to confuse the public, and ExxonMobil is being investigated by 17 state attorneys-general for fraud in lying to their investors about the effects of fossil fuels on climate change.

Global energy markets total around $6 trillion, so the competition is already fierce and ugly. Scheming tactics from the fossil fuel industry will continue, since it is increasingly a cornered animal fighting for survival. Massive disinformation campaigns have been secretly funded to confuse the public, and ExxonMobil is being investigated by 17 state attorneys-general for fraud in lying to their investors about the effects of fossil fuels on climate change.

Given the deep and widespread legacy of energy regulations in the US and developed countries, there are numerous opportunities for incumbent industries to thwart policy changes through regulatory or legislative capture. The Koch brothers, funded by their fossil-fuel empire, alone pledged to spend $900 million to influence the US elections during 2016.

Climate Effects of the Energy Revolution

The continuous bad news is that the expected expenditures on clean infrastructure are too small, too late to adequately address the climate crisis. According to climate scientists the overarching requirement is to reach nearly zero fossil-fuel emissions by about 2050:

While BNEF forecasts a $9.2 trillion investment in zero-carbon power, an extra $5.3 trillion in needed by 2040 to prevent power sector emissions rising above the IPCC’s “safe limit” of 450 parts per million (ppm). That’s an enormous pile of money; OTOH, as a percentage it seems doable.

Take Action!

On a personal level, clean tech is increasingly delivering power that is cheaper and cleaner than fossil fuels, whether from wind or solar generation at electric utilities or on rooftops, from energy efficiency upgrades, from higher efficiency automobiles or zero-emission vehicles, from high-efficiency lighting, and more. Now is the time to plan for zeroing your emissions while also saving money!

We also must pressure our governments to adopt climate-repairing policies at all levels. Examples of good policy include Portland’s resolution to ban all fossil-fuel infrastructure for storing or transporting fossil fuels within its borders or adjacent waterways. Society currently absorbs huge externalized costs of fossil fuels, and economists uniformly agree that the market needs to feel the effects of such costs. However, that is about as far as the consensus goes.

Economic Effects of the Energy Revolution

Economic Effects of the Energy Revolution